These include the completed Stamp Duty Land Tax Return, the SDLT5 certificate for your new house, proof of your previous property's sale or disposal, and any other supporting documents mentioned earlier. The forms and accompanying documents should be mailed to the following address: HM Revenue and Customs. BX9 1HD.. Land transfer duty exemptions and concessions. You may be eligible for a land transfer (stamp) duty waiver for residential property with a dutiable value of $1 million or less, whether or not you use it as your principal place of residence. You must sign your contract on or after 25 November 2020 and before 1 July 2021.

Can I Claim Back Stamp Duty On Buy To Let? Deedle Finance

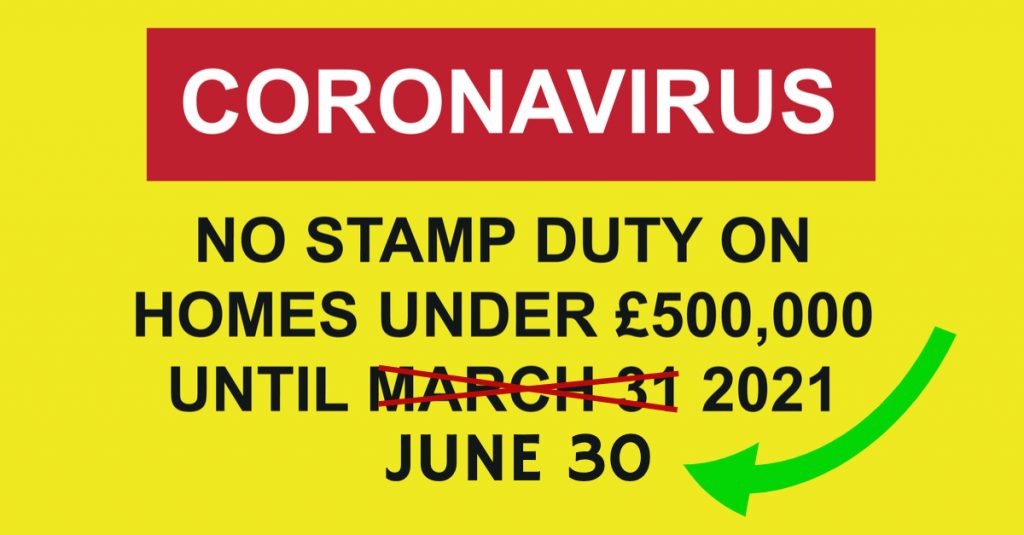

COVID19 interim measures on stamp duty announced by HMRC Tax Talks How do I claim back

What Is BuytoLet Stamp Duty? Stamp Duty Rebate

Can I Claim Back Stamp Duty On a BuytoLet? Stamp Duty Rebate

Claim Back Stamp Duty on BuytoLet Stamp Duty Rebate

Keble Homes Stamp Duty Update!

Stamp Duty What Is It and How to Avoid It on a Second Home? Review42

Enquire Today — Stampback Stamp Duty Refunds

Claim Back Stamp Duty on BuytoLet Stamp Duty Rebate

SDLT Refunds How to Claim Back Stamp Duty MoneyBright

Find out how this UKbased tax consultancy is helping people claim back stamp duty from HMRC

The IFS is quite right here, stamp duty is largely paid by pensioners — Adam Smith Institute

Stamp Duty News Archives SDLT Reclaims

How Do I Claim Back Stamp Duty? SDLT Reclaim

Stamp Duty explained Nested blog

How to claim back stamp duty and find out if you’re owed a refund worth thousands

What is Stamp Duty and Why Do You Need it? Gorvins Residential LLP

(14).jpg)

How to claim Stamp Duty back Stamp Duty Rebates

What is stamp duty and how does it work? Legal Home Loans

Can I Claim Back Stamp Duty On a Second Home? Stamp Duty Rebate

you overpay tax. To have your refund paid by electronic funds transfer (EFT), you can either: add your details to QRO Online (see how to set up bank details) or. send us these documents. completed refund by EFT form. copy of your bank statement, clearly showing the bank header, account holder name, BSB and account number. reassessment application.. The stamp duty refund and the rebate for all eligible EV purchases will end on 1 January 2024. Individuals and businesses that have purchased or placed a deposit on an eligible EV prior to 1 January 2024, and are awaiting delivery of the vehicle, will still be eligible to receive the stamp duty refund and rebate, regardless of whether the vehicle has been delivered by that date.